Imagine setting sail on open waters thinking you’re fully equipped for the journey ahead, only to find out your safety gear isn’t up to the task when a storm hits, and your safety net has big gaps. Underinsurance is that storm, lurking unnoticed until the moment you need to make a claim, and suddenly, you find the safety net you thought you had is full of holes.

In this article we explore how underinsurance can affect you, the common reasons behind it, and more importantly, the ways that you can stay protected.

What is underinsurance?

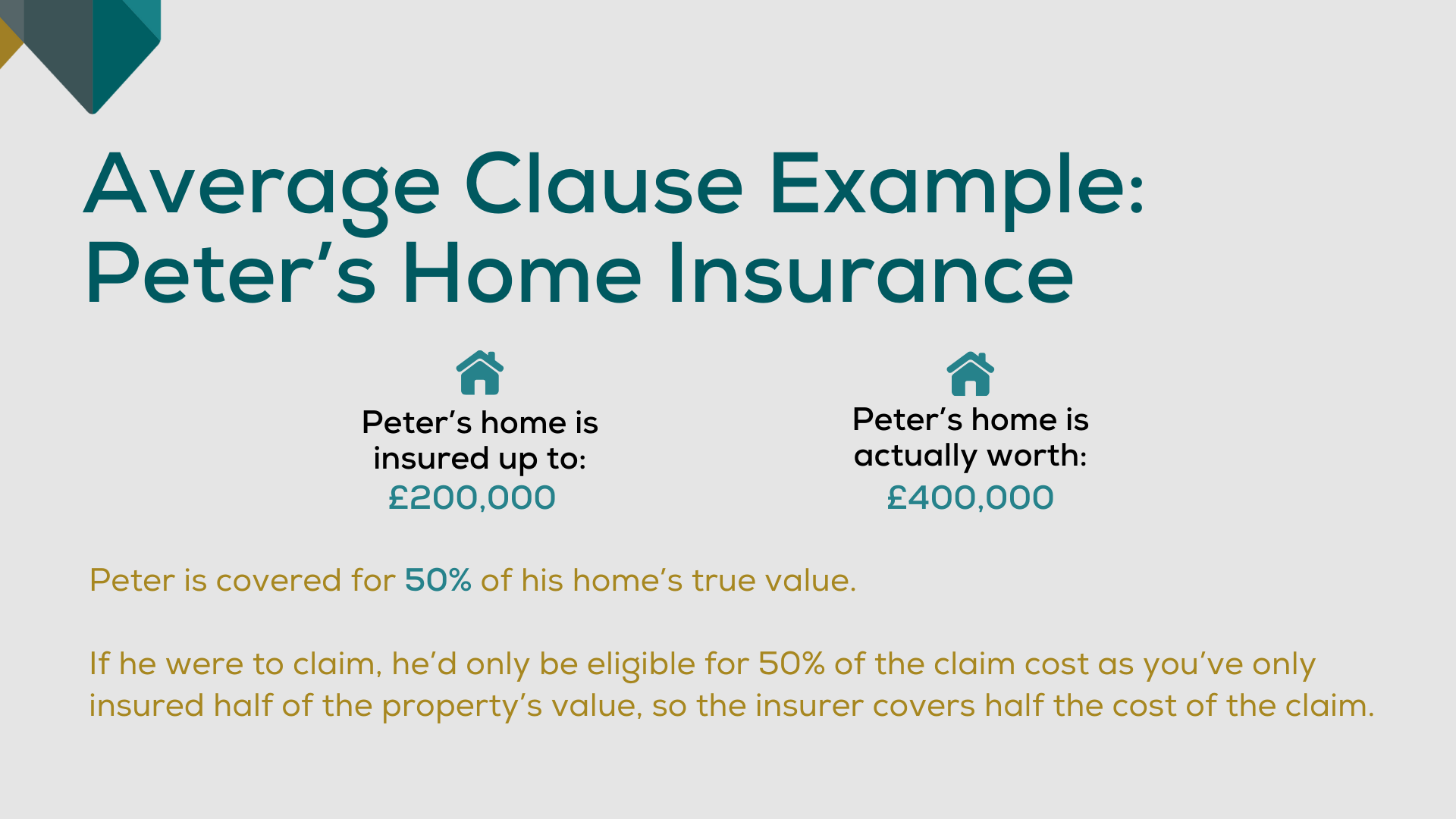

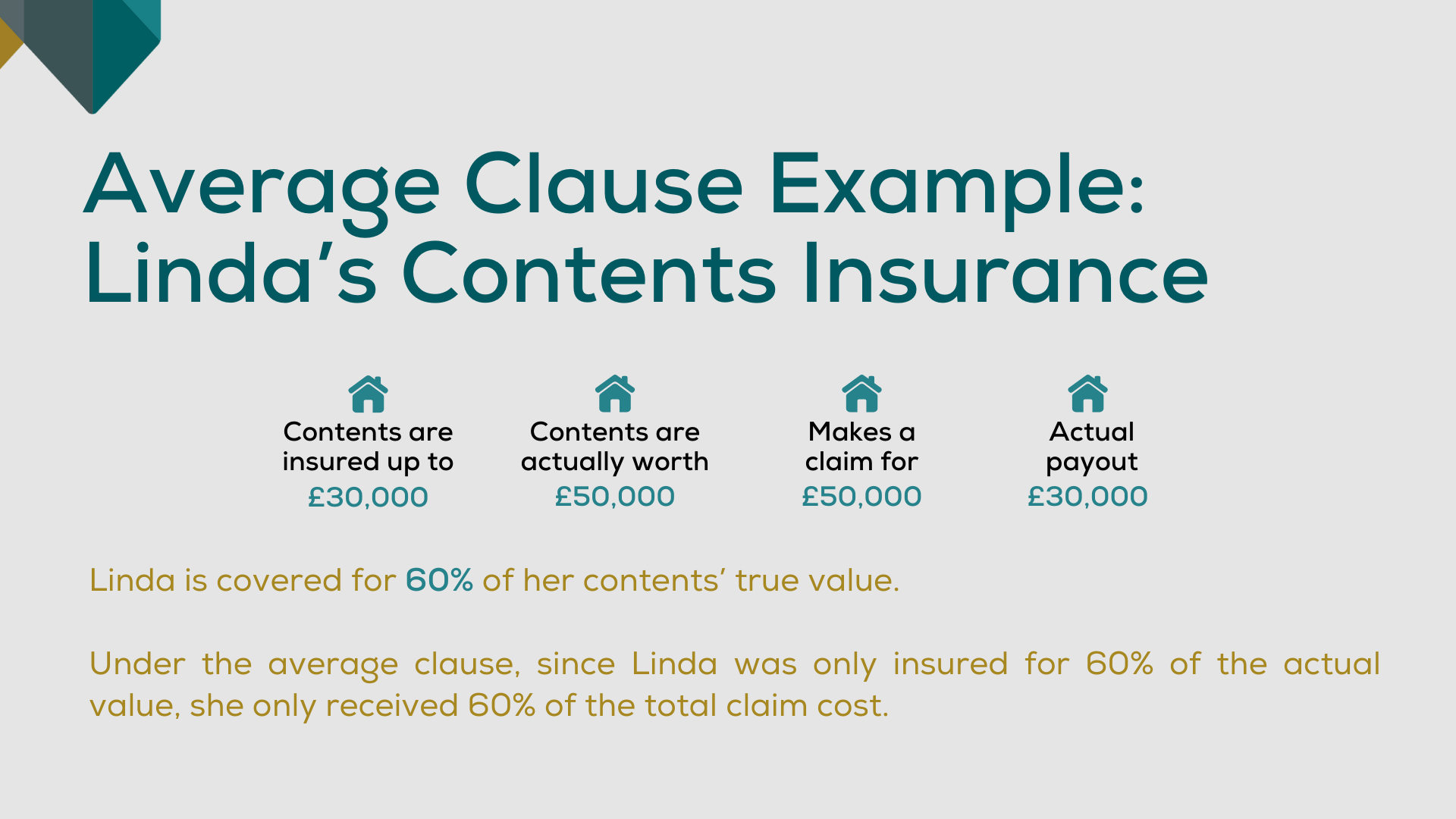

Simply put, underinsurance is the gap between what your insurance policy says you will be paid vs the actual cost to replace or repair your asset.

Whether it’s your home, car or valuable collection, underinsurance can leave you worse off financially if a disaster strikes.

Imagine being faced with a major repair bill and finding out that your insurance policy doesn’t cover the full cost. That’s underinsurance — a risk that’s easily overlooked but can have significant consequences. Being caught underinsured is a risk that nobody should be looking to take. What’s scarier is that it can even happen without you knowing.

But some people choose to be underinsured. Research from the Association of British Insurers (ABI) found that 1 in 4 households don’t cover their contents which means they wouldn’t get anything paid out to replace what they had lost.

Buildings insurance valuation company Barrett Corp and Harrington (BCH) found that 75% of the buildings they valued in 2022-23 were underinsured, with customers significantly underestimating the level of insurance they needed to protect their assets.

Does it matter if I’m underinsured?

Yes, it does. It’s a serious matter if you’re underinsured. And we’re not just saying this as we work with insurance companies; we’re saying it because we genuinely care about protecting the things that matter most to you.

Being underinsured is like buying VIP weekend tickets for the Formula 1 Silverstone Grand Prix, and instead only ending up being able to watch the practice races on the Friday. You pay into an insurance policy expecting full coverage, but when it’s time to claim, you find out you’re not as covered as you thought you were.

Though the financial burden is a big part of it, there’s also the emotional aspect that you didn’t sign up for — the stress and worry of figuring out how to cover the extra costs. Whether it’s repairing your home or replacing valuables, underinsurance can turn an avoidable situation into a major headache.

There’s also measures that people can take to protect assets including protecting a home from storm damage which can prevent the need to make a claim.

If you think you might be underinsured, we provide some helpful guidance later in the article which can help you.