Do you collect classic cars? If so, you’d be one of an enormous 1,593,827 British people who partake in the collectors’ circle: a number which has risen by 50% since 2016. ‘

There are plenty of reasons for investing in a classic. From the tight-knit car club community to the feeling of owning something with historic significance, it’s certainly nice to have an Aston Martin DB5 tucked away in the garage ready for sunny road trips along country lanes. However, with the price of collectible cars rising by around 1.5-2% each passing year, many collectors are choosing to buy classics as an investment opportunity rather than simply out of their own passion for cars.

25% of drivers who intend to buy a classic car in the next 12 months will be buying for pleasure, according to a survey by Chubb, with a larger 30% stating they’d choose to buy one as an investment opportunity. This might not be surprising considering the classic car collectors’ market is worth an enormous £7.2 billion each year[1].

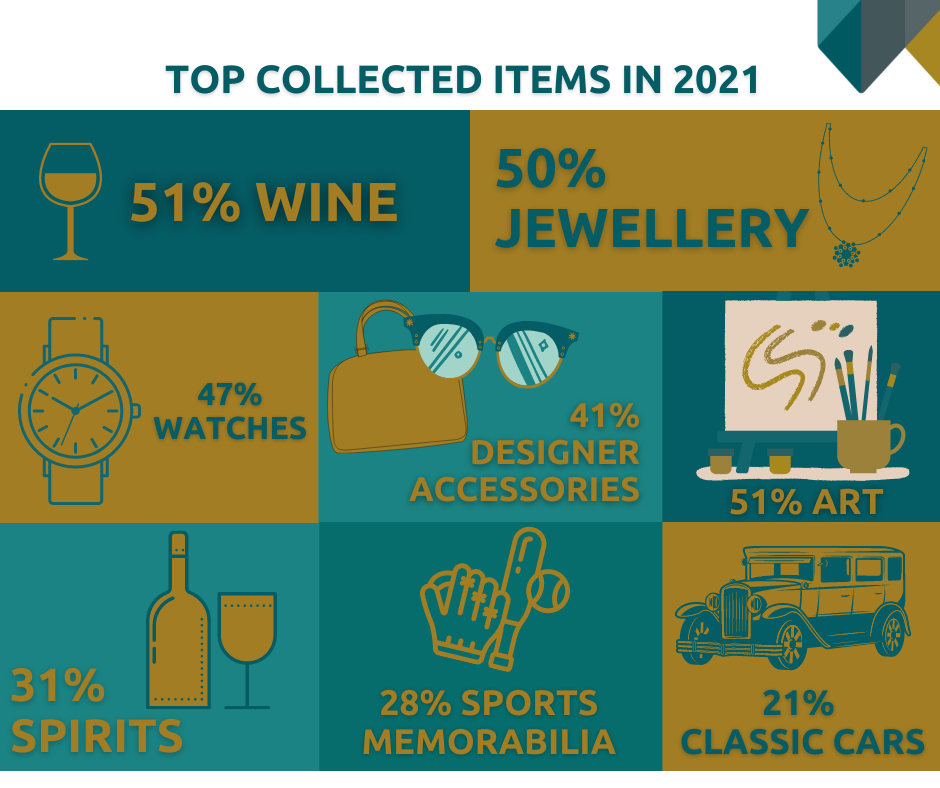

In their survey, Chubb split up collectible items up into categories, including classic cars, art, jewellery, gemstones, wine, watches, spirits, designer accessories and sports memorabilia.

There were 1,212 participants in total, all of whom had purchased a collectible item over the past 12 months. The results showed that the most popular collectible items were wine, jewellery and watches. Classic cars, on the other hand, came last on the list, with only 24% of those surveyed having bought a classic in the past year. This may not be surprising, however, especially when considering their specific storage requirements and often expensive price tags that can come with owning a classic.