As we enter 2022, the question of Covid is still at the forefront of many people’s minds. Since the first lockdown was announced in March 2020, there have been a number of changes to Covid guidelines within the UK and various adjustments to compulsory travel rules.

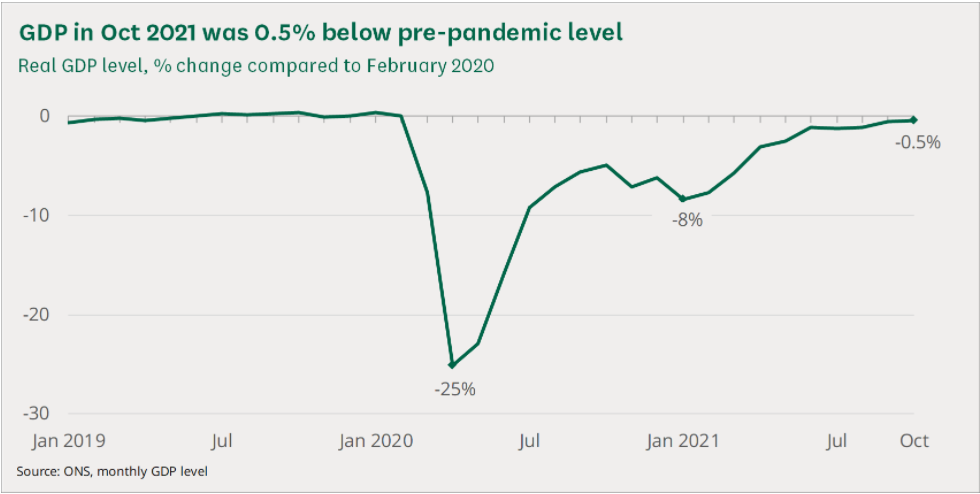

The UK economy has suffered massively over the past two years due to these necessary restrictions. According to the Bank of England, the first year of the pandemic saw the real GDP level decline by -25%. Parliament described this as ‘the steepest drop since consistent records began in 1948 and equal to the decline in 1921 on unofficial estimates.’

Despite the sharp drop at the beginning of the first pandemic, the spring and summer of 2020 saw a substantial rise in economic activity before case numbers rose again in winter, leading to further lockdowns and economic struggles at the beginning of 2021 – although this economic drop was not as severe as the levels seen in the first year of the pandemic.

According to the Guardian, the spring of 2021 marked the beginning of a strong recovery for the UK economy, which saw GDP rise to just -0.5% in October compared to pre-pandemic levels. As shown on the graph above, this has been described by economists as a ‘V-shaped recession’: a drop of activity in March and April of 2020 followed by a ‘brisk – if occasionally interrupted – recovery.’

What can we expect for the UK economy in 2022?

While the UK has regained the ground lost at the beginning of pandemic, Parliament predicted that the crisis may have caused ‘permanent damage’ to our economy. In an estimate published in October 2021, the Office for Budget Responsibility (OBR) suggests that the level of GDP will lower by 2% compared to how it may have fared if the pandemic had not happened.

The question now is whether the UK can recover this pre-pandemic trend, although this will be difficult given the predicted tough months ahead of us in 2022. January, it seems, will maintain the struggles we experienced in December 2021 due to the Omicron variant, especially in terms of staff absences within the hospitality, retail and tourism sectors. Likewise, small businesses hit by the pandemic no longer have access to the furlough scheme of previous lockdowns, meaning their recovery is reliant on the economy pushing through the final stages of the pandemic without further difficulties.