TL;DR

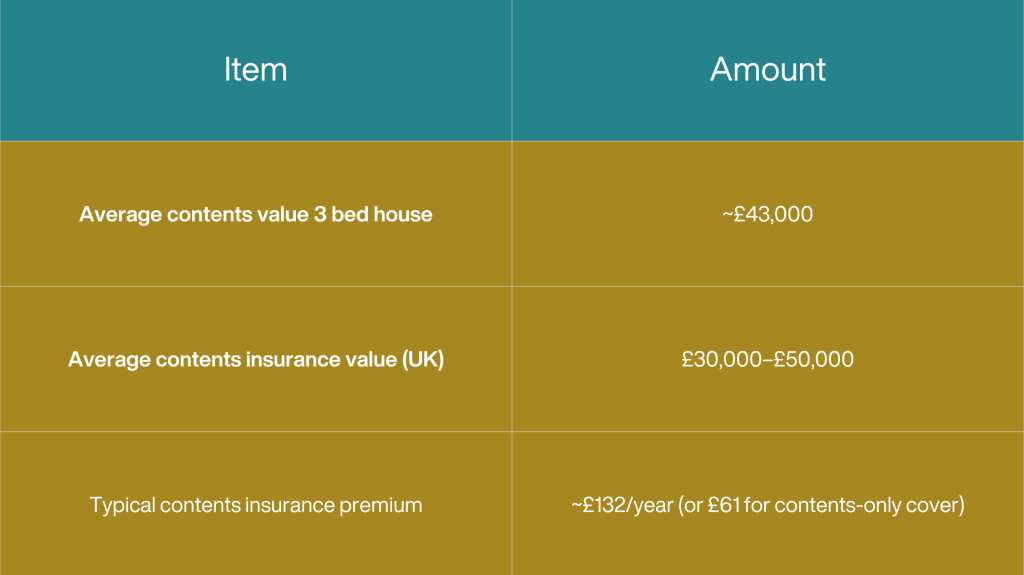

- The average value of contents in a home is around £43,000 – but yours could be more.

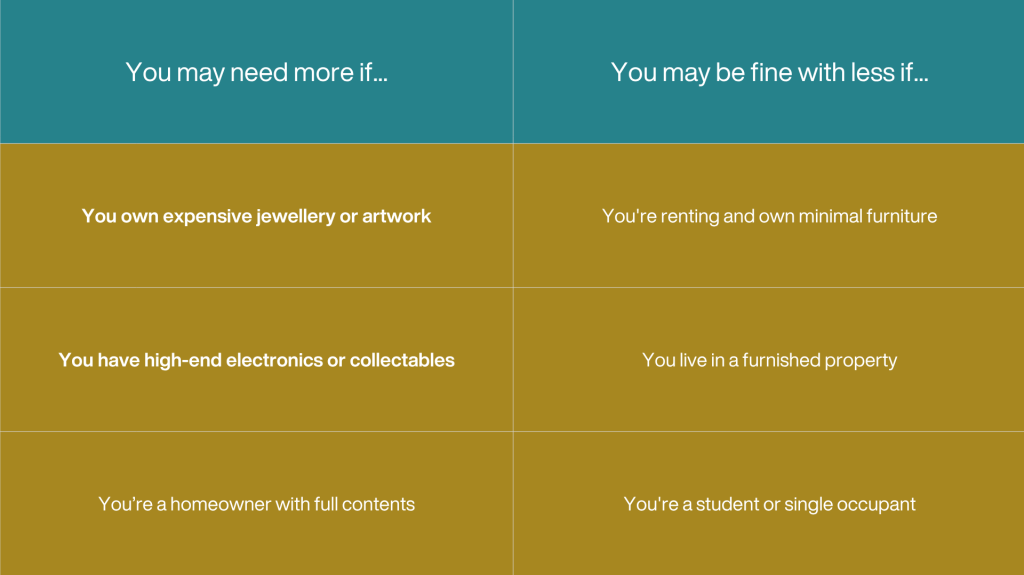

- The answer to how much home + contents insurance I need depends on your belongings and their replacement value, not what you paid for them.

- Underinsuring can leave you badly out of pocket after a claim.

- Tools like a home and contents calculator or contents calculator can help you estimate what you own.

- Many 3-bed homes need between £30,000–£50,000 of cover, but that’s just a guide.

- A typical contents insurance estimate in the UK is around £60–£150/year, but it varies based on risk and location.

Most people get this wrong. Don’t be one of them.

Most homeowners and renters only give a rough guess when asked, “how much contents cover do I need?” And more often than not, that guess is too low.

That’s a problem.

If your home suffers a fire, flood or break-in, your insurer will only pay up to the amount you insured your contents for. If you’re underinsured, you’ll be footing the bill for the rest.

So, let’s walk through what counts as ‘contents’, what it’s all worth, and how much contents insurance you might need.

What counts as “contents”?

It’s more than just the sofa and the telly.

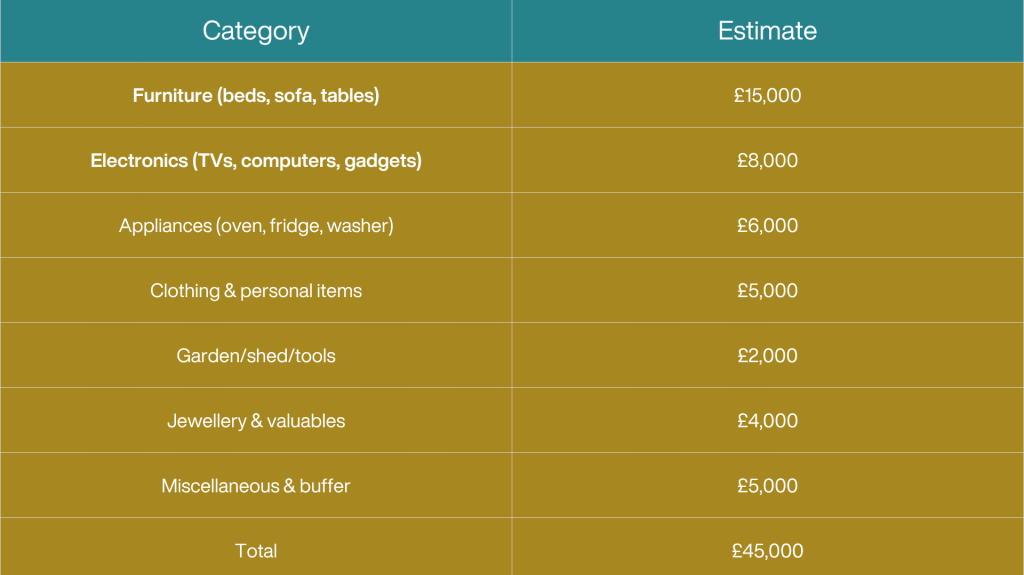

Home contents typically include:

- Furniture, carpets, curtains and rugs

- Electronics: TVs, phones, laptops, tablets

- Kitchen appliances: microwaves, kettles, toasters

- Clothing, shoes, bags

- Jewellery, watches, art

- Tools, gardening equipment, bikes

- Items in garages, lofts and sheds

- Anything you’d take with you if you moved house

Most insurers ask you to estimate the new-for-old value — the cost to replace the item now, not what you originally paid.

The average value of household contents in the UK

Wondering what the average household actually owns?

Here’s what the data shows:

So if you’re asking, “is £50,000 enough for contents insurance?”, the answer is: for many people, yes. But it depends on what you own — not the average.