What do you think of before setting off on your holiday? It could be which clothes to pack, the decision between taking a direct flight or the Eurostar, or which famous landmarks to see when you’re there. There is another important point to remember when making your holiday checklist, however: travel insurance.

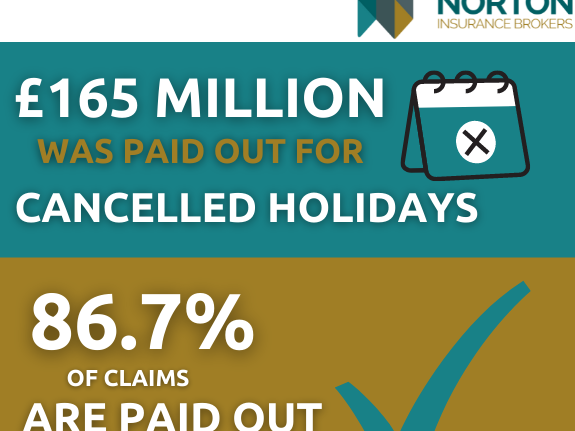

According to Finder, up to 8.6 million British holidaymakers left the UK without travel insurance in 2019. It’s a staggering amount, especially considering that £399 million was paid out in travel insurance claims alone in 2018.

Of course, fewer people were able to travel in 2020 due to the Covid-19 pandemic restrictions. Even with these restrictions in place, however, £465 million worth of claims were paid out by travel insurers throughout the year, showing just how useful the right policy can be.

What happens if I don’t take out travel insurance?

The simple answer is that you won’t be covered in case of an illness or injury. Remember: different countries have different rules when it comes to healthcare, so the cost of hospital treatment will depend on where you are in the world.

According to Finder, an enormous 28% of British people said, ‘travelling without travel insurance was a risk they were willing to take.’ However, according to the Association of British Insurers (ABI), one in three British people need emergency medical care when travelling abroad. For some travellers, going on holiday can be a very costly event if they haven’t got travel insurance to protect them from the cost of any medical care they might need.

Information by credit to Jersey Island Holidays

Information by credit to Jersey Island Holidays