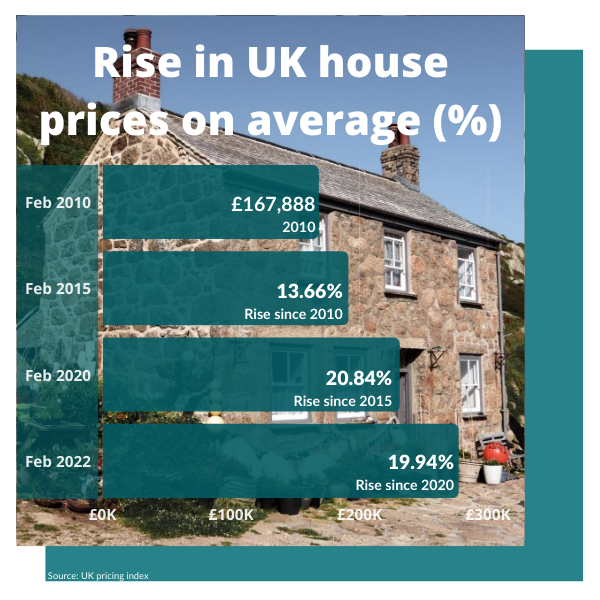

You won’t be surprised to hear that house prices in the UK have risen yet again. In fact, the UK price index shows homes are at an all-time high as of June 2022, with the average cost of buying a home in the UK coming in slightly under £300,000.

After the home buying rush of 2021, there’s now an imparity between supply and demand. It’s estimated that 9 out of 10 house hunters have had their search affected by a lack of available properties. Rightmove’s house price index shows that the rate at which homes are being snapped up has rapidly increased, with properties being sold so quickly, buyers are entering into bidding battles resulting in properties being sold for thousands of pounds over the listed price. This directly contributes to the overall increases as well as other factors.

Why does it keep going up?

It’s no secret that house prices have been on the up for years, with Covid, redundancies and reduced housing development all contributing factors. The best way to explain the increase trends is to look at a timeline of key events and the effect these have had on the housing market.

January – December 2019

Before Covid changed the way we work and live. House prices had been following a steady incline for some years, but this didn’t deter buyers. With various schemes introduced to help first-time buyers get on to the ladder and others investing in properties to renovate and let. It seemed to be working well. Although buying a home was not to be taken lightly. The deposit alone, mortgage rates and cost of living all had to be carefully considered before fully committing. After all, owning and maintaining a home isn’t cheap (and that was then).

March 2020

Locked down indefinitely with uncertain rules, Covid caused disruption to all areas of our lives; weddings, holidays, work, social gatherings and, of course, any plans to buy or sell a house. The country came to a halt. During this time, house prices fell to their lowest point since 2011 and the total number of sales per month also dropped to a historic low.

July 2020

The government introduced a temporary stamp duty ‘holiday’ in an attempt to get the property market moving again after the first lockdown – a welcome move for those who benefitted!

The stamp duty cut and the end of Covid-19 lockdowns meant that many people moved house sooner than they otherwise would have done, resulting in transactions peaking at nearly 200,000 in June 2020 – double the figure you would see in a ‘normal’ year.

Ultimately, this then led to a lack of available homes on the market and prevented prices from falling, which kept the market steady as 2021 began. On a brighter note, this also meant an end to the delays in mortgage approvals, and slowed down moves to a more manageable pace.

September 2021

With Covid vaccination rolled out and restrictions largely lifted, there was a boom in many areas of the economy, especially the housing market. “homes that look like the last turkey in the Christmas shop window are flying off the shelves at the moment”, said estate agent Henry Pryor in an interview with the Guardian (Sep 2021).

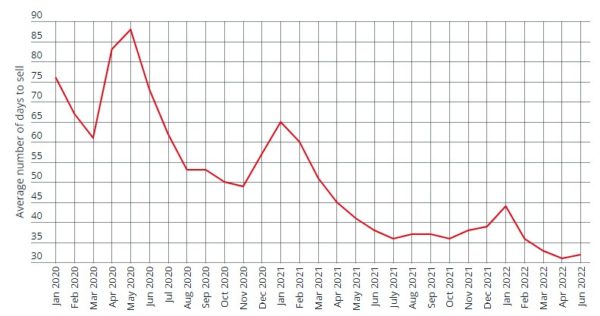

Below, a line graph from Rightmove shows that in September 2020, the average number of days a house would be on the market was 54; by September 2021, the average on-the-market time was just 36 days.

With some predicting the housing demand and price boom to continue to accelerate for years to come, there were many more factors at play during this time. Such as, the furlough scheme which was set to end September 30th – likely to leave many more people unemployed, which would in turn affect the number of people buying houses.

On the flip side, the situation made it more appealing for private landlords to sell homes, with the attractive higher value they could fetch. But the supply and demand surge forges on even now, nine months later.