At first glance, packaged bank accounts seem like a great deal. Pay a minimal monthly fee, get insurance cover for your phone, breakdown cover and for travelling.

But they’re not all what they make out to be. While the allure of convenience can be tempting, you could end up paying for protection that doesn’t fully cover your needs – possibly leaving you underinsured. Before you sign up to one, or if you’re currently signed up: are you getting the cover you think you are?

In this article, we’ll delve into what to look out for with packaged bank accounts, break down what they actually offer and suggest how having a tailored policy through a specialist insurance broker is likely a smarter and safer option.

Let’s see what you’re really paying for.

What are packaged bank accounts?

Packaged bank accounts are current accounts that offer additional perks in exchange for a monthly fee.

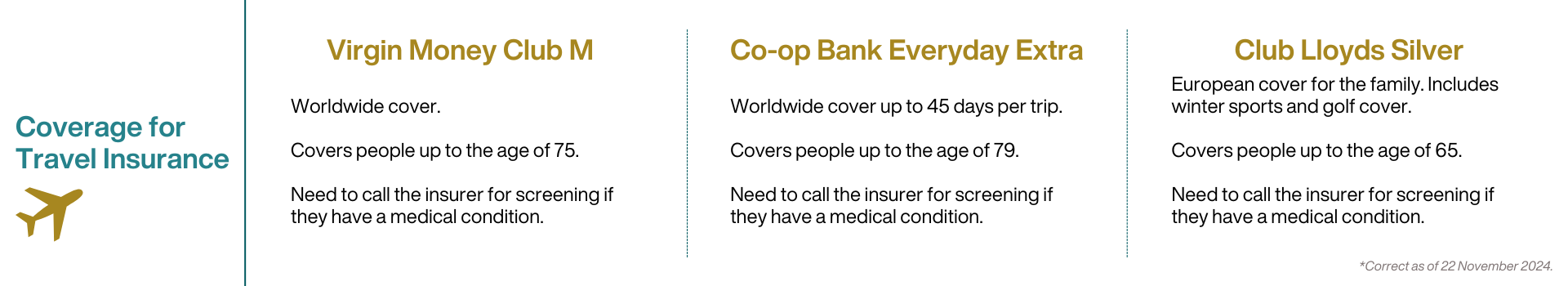

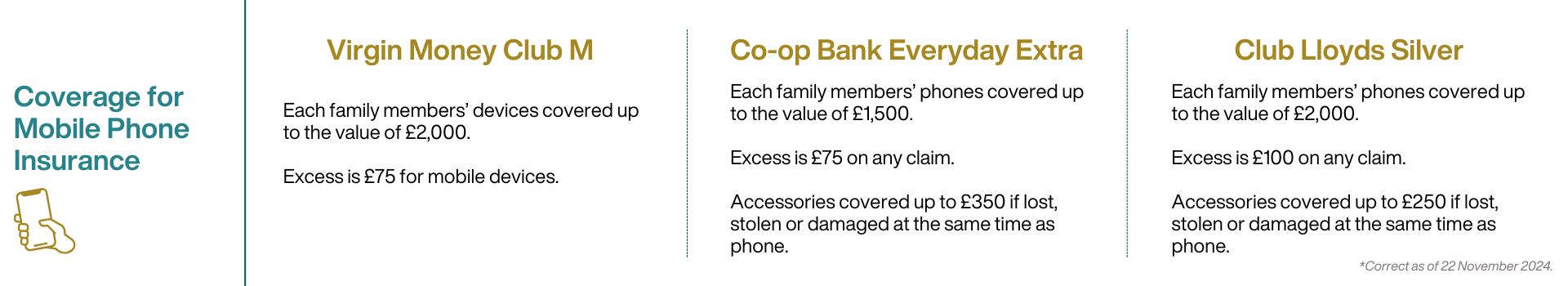

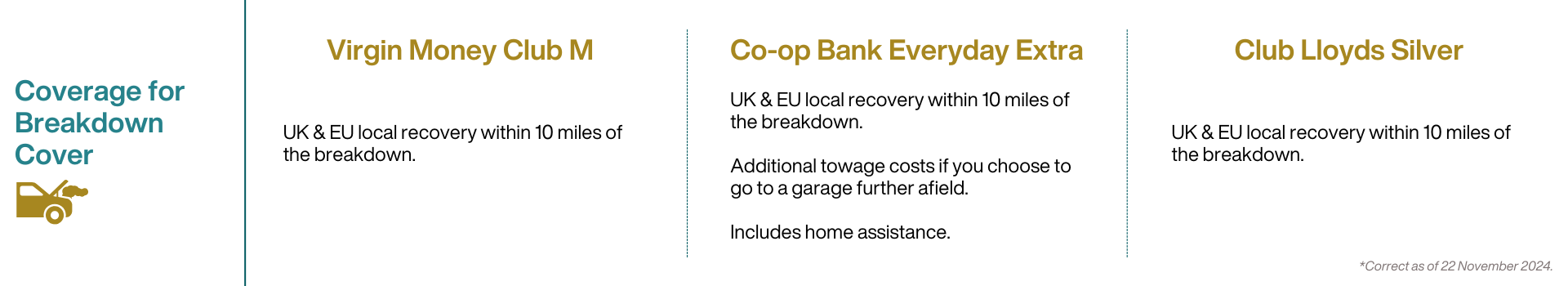

More often than not, these are insurance products bundled together, marketed as a convenient way to cover you without shopping around for separate policies. The main products that make these accounts up are for travel insurance, mobile phone insurance and breakdown cover.

There’s no denying that packaged bank accounts are convenient and cost-effective, but the insurance cover you get is often sacrificed. This is totally okay if you want to minimise costs, we get it.

Do you even need all of those extras? Historically, packaged bank accounts were once known to be one of the most complained about financial products. 90% of complaints to the Financial Ombudsman Service from consumers believed they were mis-sold the accounts, in recent years.

Nationwide recently announced they will be hiking their FlexPlus packaged bank account fee from £13 to £18 a month – a 27% increase – from December 2024. If you currently have a packaged bank account, be wary as you may see similar increases too.

If you’d prefer to get quality coverage where you can be confident that you’ll be fully paid out in the event of a claim, you’re in the right place. With us, you’ll also get your own dedicated Personal Client Manager who you can call directly for any queries relating to your policy for no extra cost.

Comparing some of the ‘best’ packaged bank accounts

We have analysed some of the top packaged bank accounts selected by the credible consumer website, Money Saving Expert. These accounts are selected purely on their value for money where insurance cover is less than a standalone policy through a specialist insurance broker like us.

A little about the accounts we’ve analysed:

- Virgin Money Club M: Supposedly suitable for families. Annual cost is £150.

- Co-op Bank Everyday Extra: Supposedly suitable for older travellers or couples. Annual cost is £180.

- Club Lloyds Silver: Supposedly suitable for older travellers or couples. This account requires a minimum pay-in of £2,000/month, or there is an extra fee of £3/month. You can choose an annual reward. Annual cost is £138 to £174 depending on your minimum pay-in amount.

Each of these accounts include travel insurance, mobile phone insurance and breakdown cover. Let’s take a look at how they compare, looking closer at the cover you get and how they compare vs insuring with us.

Please note that information is correct as of 22nd November 2024. The cover and cost may change in future months.