Ski holidays are thrilling, but they’re also high-risk. According to ABTA Winter Sports Report, around 25% of ski travellers experience minor to moderate injuries, while nearly 30% of Brits do not realise standard travel insurance doesn’t automatically cover skiing or snowboarding.

According to the same report, over 1.5 million UK travellers visit ski resorts every winter, making dedicated winter sports cover more important than ever.

But unfortunately, not every travel insurance policy covers ski insurance. Adding skiing insurance ensures that whether you’re carving in Courchevel or snowboarding in St Anton, you’re covered for gear damage, piste closures, medical costs, and even avalanche delays.

With the help of Norton Insurance experts, you can tailor your cover to include essential winter sports protection, ensuring that your ski trip stays stress-free from lift pass to après-ski. From delayed equipment and lost gear to medical emergencies, Norton makes sure you’re ready for the slopes with peace of mind built in.

What Does Skiing Insurance Typically Cover?

Skiing insurance covers winter-specific risks like injuries, lost equipment, and piste closures, which standard travel insurance usually doesn’t include. It’s a tailored add-on that protects you on and off the slopes. From damaged gear to avalanche delays, it ensures you’re covered where it counts.

Included Ski Cover Benefits:

- A Cover for stolen, damaged, or lost ski equipment (owned)

- A Cover for hired ski equipment loss or damage

- A Cover for hiring temporary equipment if yours is delayed or lost

- A Cover to reimburse unused ski packs (e.g., lift passes, ski school fees) if you’re injured or sick

- A Cover for lost lift passes

- A Cover for piste closures due to snow conditions

- A Cover for extra accommodation/travel if delayed due to avalanche

This type of cover is typically available as an optional upgrade on annual or single-trip travel insurance policies for UK residents.

Does Travel Insurance Include Skiing Cover by Default?

No, most standard travel insurance policies do not automatically include ski cover. You’ll need to specifically add a winter sports upgrade when you purchase your policy. This applies whether you’re getting a one-off trip plan or annual multi-trip coverage.

Some providers allow you to customise your quote and build ski cover into your annual policy from the start, a smart move if you’re planning more than one trip a year.

Also note: If you’re travelling as a family, ski insurance should be added for each covered person participating in snow sports.

Can I Add Ski Cover to My Annual Travel Insurance?

Yes, many UK insurers allow you to add ski or winter sports cover to your annual travel insurance policy. This is especially useful if you’re planning more than one holiday in a year, such as a winter trip and a summer getaway.

You can often build ski cover directly into your quote when purchasing your policy, or add it later as an upgrade. Some providers even offer a choice of insurers for winter sports, which lets you compare levels of cover, policy wording, and costs before you decide.

Just remember: every person travelling needs to have ski cover applied individually, especially for family or group trips.

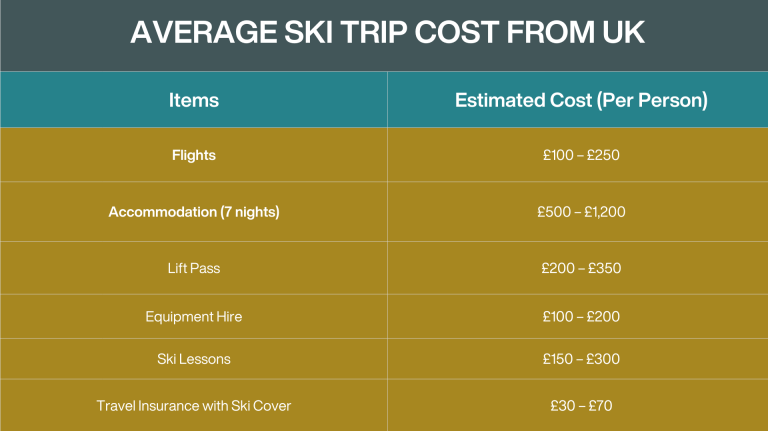

How Much Does a Ski Trip Cost?

A ski holiday typically costs between £1,200 and £2,200 per person from the UK. This includes flights, accommodation, lift passes, equipment hire, and insurance. See the full breakdown below for a clearer picture of where your money goes.